4. The Difference Between Personal Assets and Personal Liabilities.

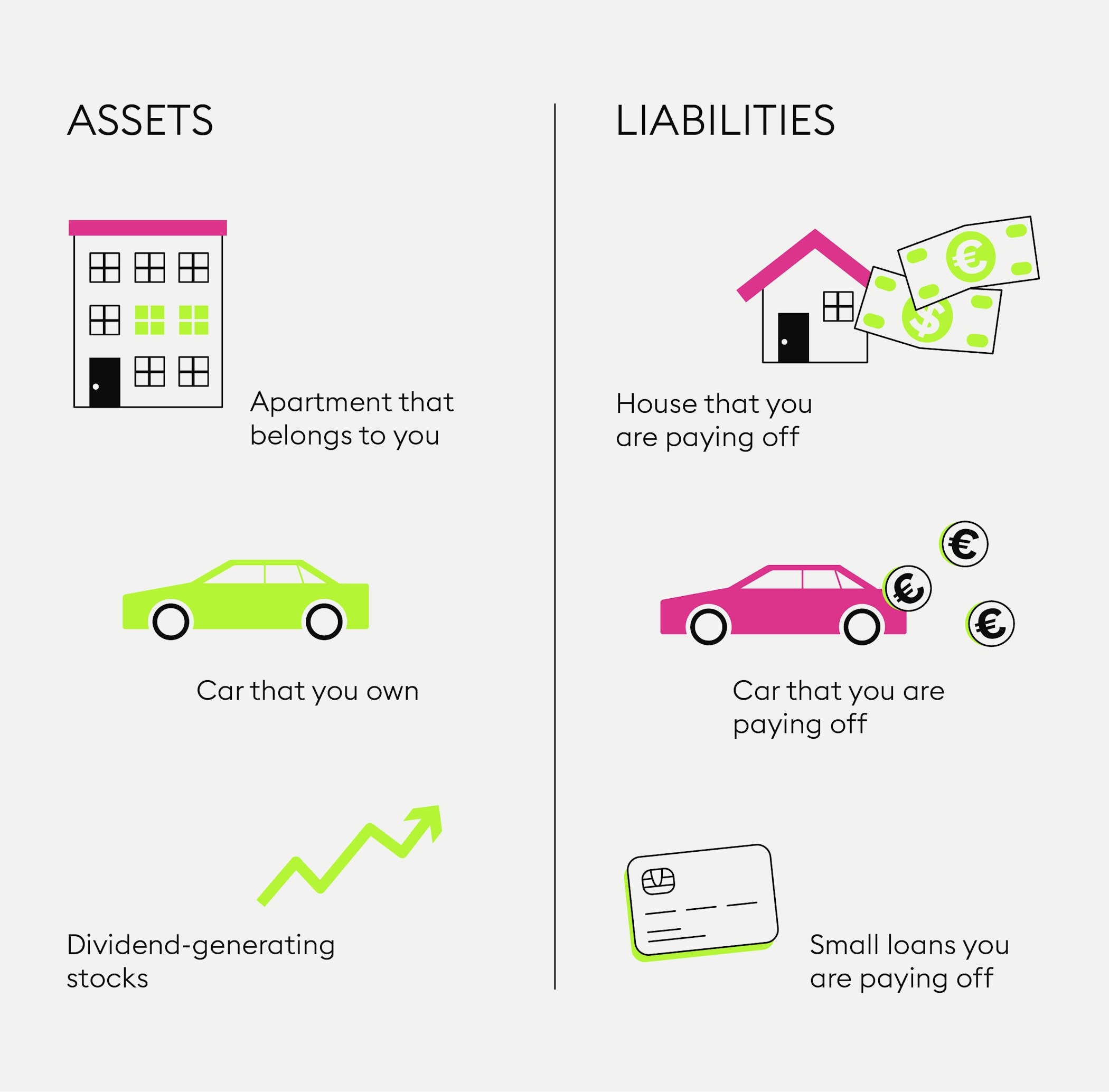

An asset is something which is owned and controlled by an entity. The difference between your assets and your liabilities is your net worth.

Personal Balance Sheet Uses Examples Video Lesson Transcript Study Com

Then estimate your living expenses.

. Compare the options you have identified. Difference between assets and liability in business. It is responsible for generation of cash flow for a business.

A business owned by one person. The principals of right and wrong that guide an individual in making decisions. On the other hand a liability is a present obligation which has to be settled in future.

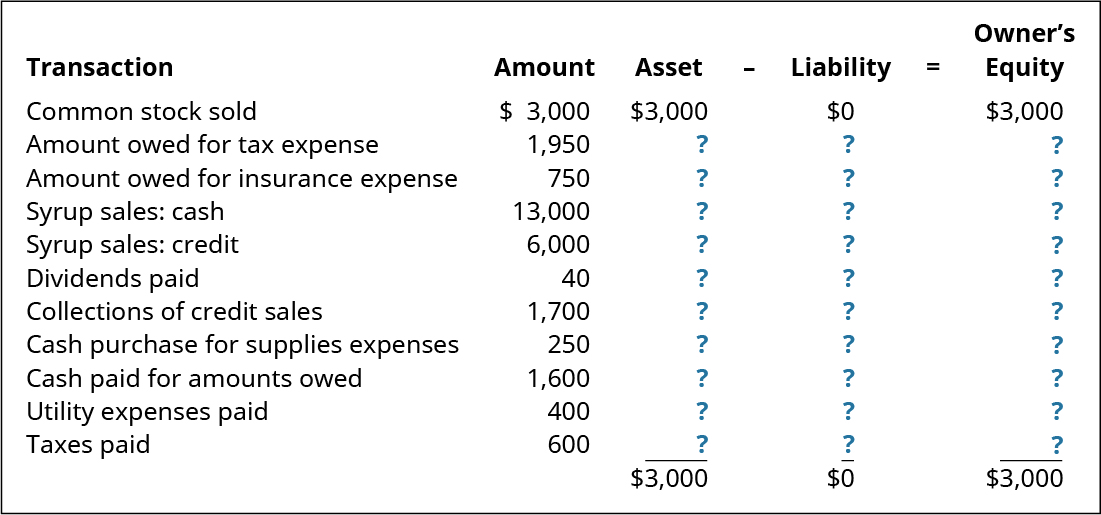

Assets and liabilities are the two pillars of accounting and every student going into commerce field will hear these two terms more often than his or her name. An outstanding balance on her business credit card from buying a new laptop an unpaid cell phone and internet bill sales. Assets Liabilities Equity.

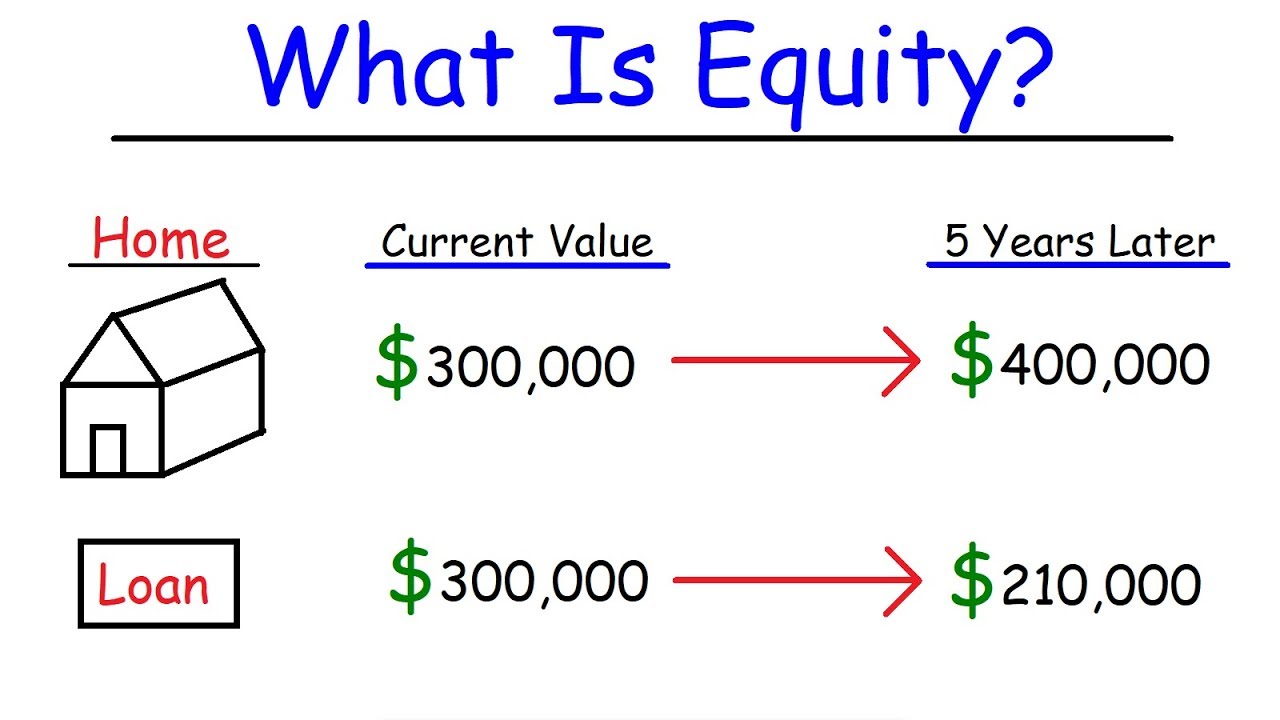

An asset is any thing or item that adds value to your business where a liability is something that is going to take away value from your business. The difference between assets and liabilities similar to personal net worth Equity. And turn it into the following.

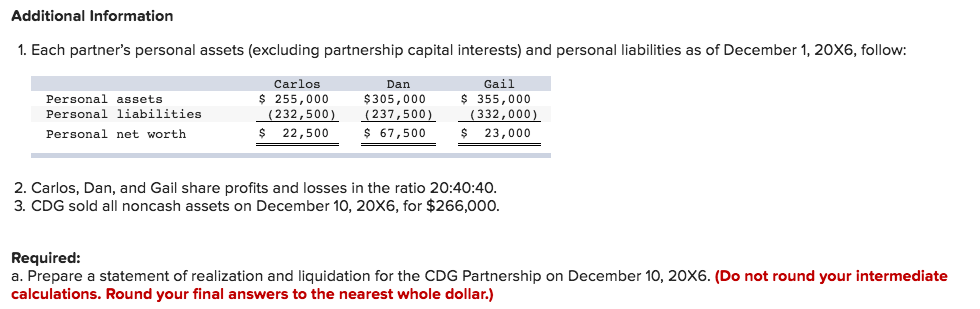

It in the given data the assets are cash investment house and car. Assets Liabilities Shareholders Equity. Net worth for a company is total assets minus total liabilities.

Debit Cash in hand 5000. Impact on cash flow. Differences between Assets and Liabilities.

Liabilities on the other hand are the obligations an individual has and should be met in a predetermined time in the future. Assets are the thing which gives the future profits and liabilities are the obligations. Use of ethics in making business decisions.

Cash flow refers to the amount of cash being received positive cash flow and spent negative cash flow. The main difference between assets and liabilities is that assets add value to your business while liabilities subtract from it. Liabilities Assets Shareholders Equity.

Assets are resources that you own while liabilities are obligations that you have the difference between them is your equity in the company. An increase in equity resulting from the sale of goods or services. These items can be valued and can be used to meet any financial obligation such as debts commitments and the legacies.

Items needed to survive such as food clothing shelter and medical care. Difference between Asset and Liability. The principles of right and wrong that guide an individual in making decisions.

The difference between your assets and your liabilities. Liabilities are items that are obligations for a business. Liabilities refer to the economic obligations of the firm resulting from past events which can be identified and measured accurately.

Looking at the two it is much easier to see how they work together and how every business has both assets and liabilities both. Now what is net worth. List options for meeting the need.

Impact of Depreciation Assets are depreciable in nature. The difference between assets and liabilities. If you want to attract more wealth and feel more wealthy then you need to learn to think like a wealthy person.

Some expenses are likely to decrease while others will increase. Assets Liabilities Equity. What is the difference between assets and liabilities.

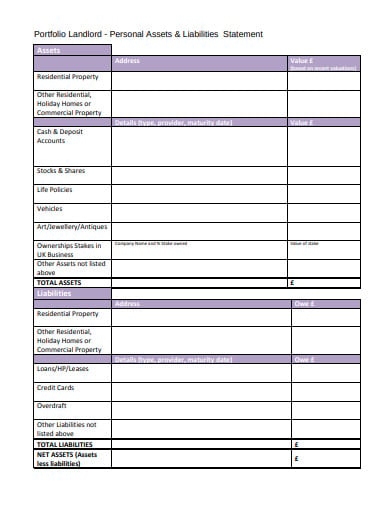

Lets take the equation we used above to calculate a companys equity. Accountants call this the accounting equation also the accounting formula or the balance sheet equation. Assets refer to the items such as property which the organization has legal ownership to.

The main difference between assets and liabilities is that one adds to a companys net worth while the other deducts from it. Difference between Assets and Liabilities. It in the given data the liabilities are credit card personal loan mortgage and car loan.

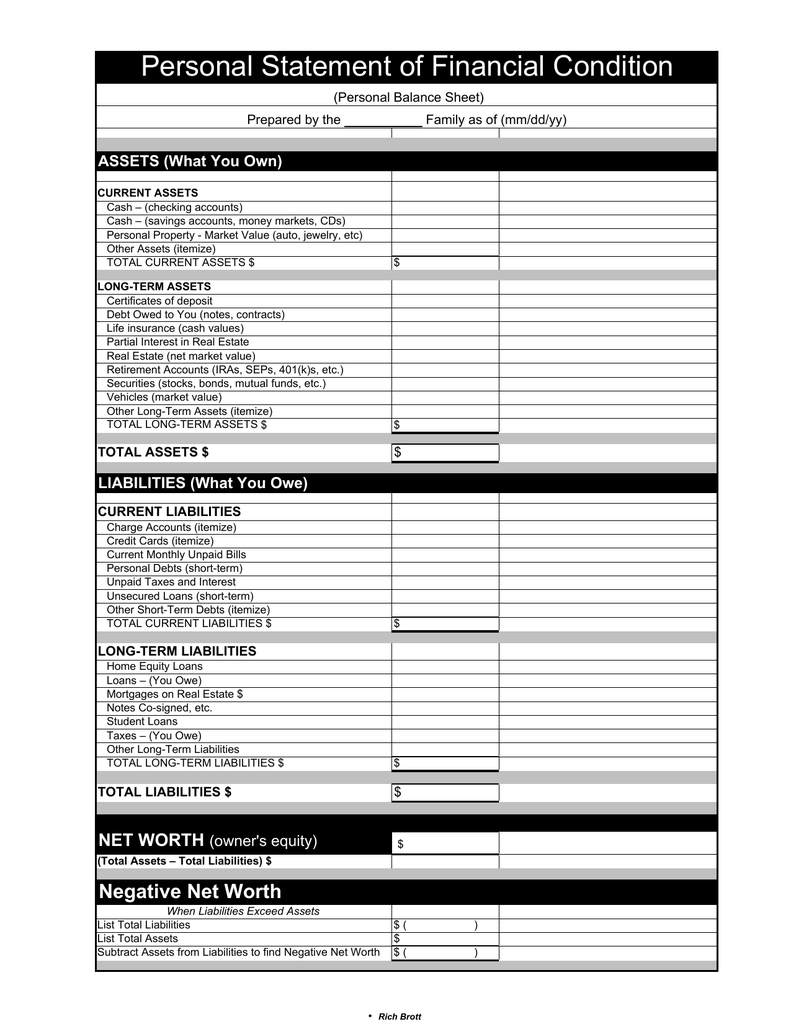

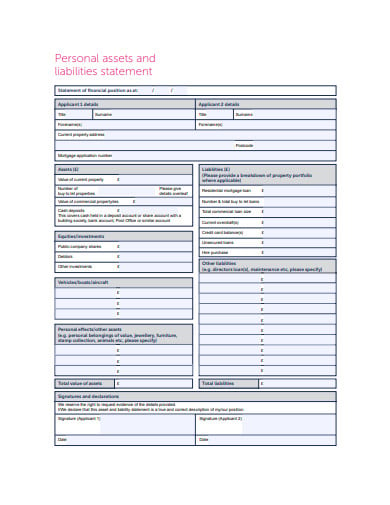

A laptop a printer cash in her business bank account payments pending from two clients. When determining the value of your business and its financial stability you add up each of your assets and subtract your liabilities. The difference between personal assets and personal liabilities.

It is capable of bringing some financial gain in the future. An equation showing the relationship among assets liabilities and owners equity. Asset implies resources that owned and controlled the enterprise as a result of past events from which economic benefits are expected to derive in the future.

But if you remain confused about these two concepts read on as this article attempts to clarify these terms. To record the loans receipt in his books Jack must increase both his assets cash in hand and liabilities loan from Jimmy by the same amount. In a very generalized way a liability is anything that takes money out of your pocket an asset is anything that puts money back in your pocket.

Before proceeding on our journey towards attaining personal freedom I have to know whats my net worth. The Definitions of Assets and Liabilities. Anything of value that is owned.

A sale for which cash will be received at a later date. The use of ethics in making business decisions. March 19 2018 August 31 2012 by Vinish Parikh.

To understand both the terms better lets look at some of the differences between assets. It is important to understand the differences and clarify what assets and liabilities are if you want to attract more wealth into your life. Review your assets to ensure they are sufficient for retirement.

The difference between personal assets and personal liabilities. Assets taken out of a business for the owners personal use. In context to accounting standards assets refer to something which is owned by someone and has the ability to provide.

The 5000 cash is an asset for Jack that he can use to start his business. The Difference between personal Assets and Personal liabilities. Liabilities are what the company owes whether to employees customers or banks.

Calculate how much money an older household with an annual income of 40000 spends on housing each year. Principles of right and wrong that guide individual in decision making. Assets are the things owned by a company and therefore add to the companys value.

He now also has a liability of the same amount that is owed to his friend. The difference between personal assets and personal liabilities. Liabilities are non-depreciable in nature.

Difference between personal assets and personal liability.

Personal Statement Of Financial Condition Assets What You Own

4 Types Of Business Structures And Their Tax Implications Netsuite

Using Llcs To Protect From Inside And Outside Liability

What Are Assets And Liabilities Bitpanda Academy

13 Assets Liabilities Statement Templates In Doc Pdf Free Premium Templates

Personal Finance Assets Liabilities Equity Youtube

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

13 Assets Liabilities Statement Templates In Doc Pdf Free Premium Templates

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

Personal Balance Sheet Uses Examples Video Lesson Transcript Study Com

List Your Assets Vs Liabilities To Calculate Net Worth Personal Financial Statement Word Problem Worksheets Worksheet Template

Understanding Your Personal Life Balance Sheet The Art Of Thinking Smart

Pin On Printable Template Example Simple

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Personal Financial Statement For Excel

Solved The Cdg Carlos Dan And Gail Partnership Has Decided Chegg Com

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Comments

Post a Comment